osceola county property tax rate

Public records show Disney is the largest taxpayer in central Florida paying. Irlo Bronson Memorial Hwy.

![]()

Osceola County St Cloud Propose Smaller 2021 22 Budgets Osceola News Gazette

The Tourist Development Tax is a charge on the total rental amount charged to a guest for any short term rental less than 180 days.

. Compared to the state average of 121 homeowners pay an average of 000 more. Tourist Development Tax Osceola County Code of Ordinances Chapter 13 Article III Tourist Development Tax. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email.

Scarborough CFA CCF MCF March 24 2022 206 pm. How to pay tourist development tax for my vacation rental in Osceola. 2 days agoSo the counties will have to raise property taxes to make up the difference.

If purchasing new property within Florida taxes are estimated using a 20 mill tax rate. If Osceola County property taxes are too high for your revenue resulting in delinquent property tax payments you can take a quick property tax loan from lenders in Osceola County FL to save your property from a looming foreclosure. You may utilize our online filing system or mail your TPP Return to our office.

The estimated tax range reflects the lowest to highest total millages for the taxing authority selected. Search all services we offer. It is the responsibility of each taxpayer to ensure that hisher taxes are paid and that a tax bill is received.

The total rental charge is any. For more information go to the Tax RollMillages link on the homepage. Osceola County Florida For the 10th consecutive year the countys general fund millage rate will not increase under the county managers recommended budget presented to County Commissioners on July 15 2019The overall proposed tax rate also remains the same as last year at 82540 mils for the general.

Osceola much smaller and less wealthy is still working on its figures. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart. We use a Market Value range of 875 to 1125 of the purchase price you enter.

Osceola County Florida Property Search. Osceola County Tax Collector - Office of Bruce Vickers. Create a free account and review your selected propertys tax rates value assessments and more.

Overview of Osceola County FL Property Taxes. Ad Valorem taxes on real property are collected by the Tax Collector on an annual basis collection begins on November 1st for the current year January through December. Out of the 67 counties in Florida Osceola County has the 5th highest property tax rate.

Any supporting documentation can be e. Learn how Osceola County levies its real property taxes with our detailed review. On top of the 105 million Disney also pays local property taxes.

Osceola Tax Collector Website. Under Florida law e-mail addresses are public records. If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity.

Effective July 1 2004 the Tourist Development Tax increased to 6 in Osceola County. Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523. To claim excess overbid funds after a sale submit the Affidavit of Claim for Tax Deed Sale Surplus Funds to the Clerks Office at.

Irlo Bronson Memorial. Tonia Hartline 301 W. Osceola County Property Appraiser.

OSCEOLA COUNTY TAX COLLECTOR. Put another way if you live in Osceola County you can expect to pay 1210 for every 1000 of real estate value or 121. The situation quickly prompted warnings that county property taxes will.

In-depth Osceola County FL Property Tax Information Assess all the factors that determine a propertys taxes with a detailed report like the sample below. They must tax every property equally not just Disney and therefore its expected that property taxes in Orange County will rise as much as 25 next June 2023. 2505 E Irlo Bronson Memorial Highway.

Osceola County Tourist Tax for HomeAway VRBO and FlipKey Set tax rate to 135 by doing so you are collecting the proper occupancy tax for your vacation rental. If you are considering becoming a resident or only planning to invest in the countys real estate youll come to know whether Osceola County property tax regulations are helpful for you or youd rather look for another location. Osceola County Property Appraiser Katrina S.

Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241. The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of 095 of property value. Attention Osceola County business owners the deadline to file your tangible personal property TPP return is April 1st.

2 days agoFlorida taxpayers may suffer Orange and Osceola counties could take on a massive debt held by Disney now that Gov. Armando Ramírez Osceola County Clerk of the Court Tax Deed Department 2 Courthouse Square Kissimmee FL 34741. The Tax Collectors Office provides the following services.

Visit their website for more information.

School Board Meeting Agenda Packet Osceola County

School Board Meeting Agenda Packet Osceola County

Osceola County Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Fl Property Tax Search And Records Propertyshark

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

Property Tax Search Taxsys Osceola County Tax Collector

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Celebration Fl Lake Garden

Osceola County Fl Property Tax Search And Records Propertyshark

Osceola County Fl Property Tax Search And Records Propertyshark

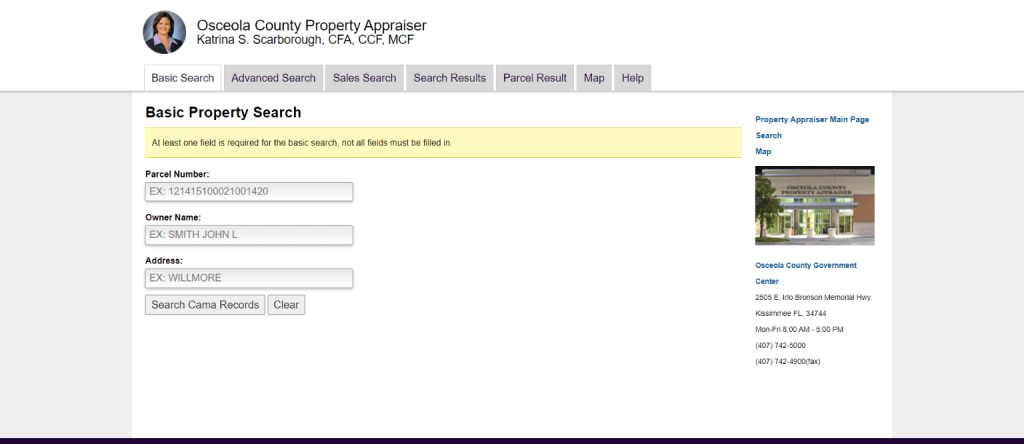

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Property Appraiser How To Check Your Property S Value

Curriculum Amp Instruction Consent Agenda Osceola County School

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Fl Property Tax Search And Records Propertyshark